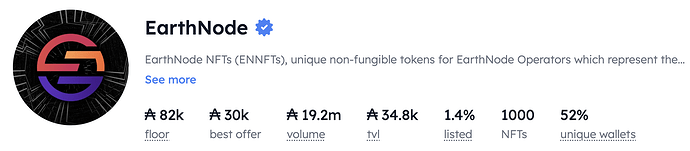

EarthNodes have become the most valuable NFTs in the Cardano ecosystem, with prices reaching over 90,000 USD on jpg.store. As World Mobile Chain approaches its launch, could these digital assets still be undervalued? Let’s explore this question.

What are EarthNodes?

Currently, EarthNodes exist as digital tokens in holders’ wallets – NFTs that might seem unremarkable at first glance. Unlike traditional NFT collections focused on rarity and artistic value, EarthNodes serve a crucial technical purpose: they grant the right to operate a node on the World Mobile Chain. This creates an important distinction from other blockchain networks like Cardano, where anyone can operate a node without restriction. On World Mobile Chain, node operation is exclusively reserved for EarthNode NFT holders.

These nodes form the backbone of World Mobile’s network infrastructure, performing verification functions that ensure system integrity. When users make calls, consume data, or access services, EarthNodes validate and verify these interactions across all network components, including AirNodes and user devices. This verification process maintains the security and reliability of the entire World Mobile Chain ecosystem.

Now that we understand what EarthNodes are, let’s explore why their current market valuation might not reflect their true potential, starting with the network’s impressive growth trajectory. Let’s dive in the reasons why EarthNode might get a bump in price very soon:

1 - World Mobile Network & User Growth Potential

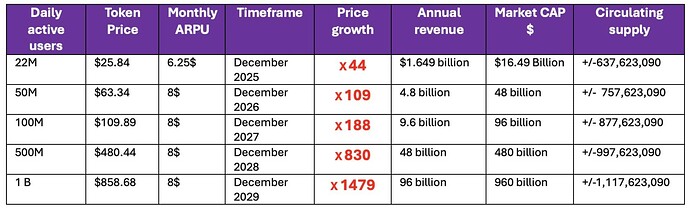

World Mobile has established itself as the telecommunications industry’s leading DePIN project, with metrics that demonstrate real-world adoption. The network already serves over 545,000 daily active users, processing more than 350 terabytes of data daily – surpassing the performance of competitors who currently hold higher market valuations.

The network’s expansion plans showcase its potential for explosive growth. World Mobile has secured agreements to onboard millions of users in Pakistan within the next 12-18 months, while parallel negotiations in the Philippines could add another 12 million customers. These concrete partnerships demonstrate World Mobile’s ability to scale rapidly across diverse markets.

The upcoming launch of World Mobile’s U.S. cellular network in January 2025 represents another strategic milestone. By becoming the first true mobile network operator in the cryptocurrency space to enter the U.S. market, World Mobile gains access to one of the world’s most lucrative telecommunications markets. This high-ARPU market entry validates the project’s technology and business model while opening significant revenue opportunities.

World Mobile’s innovative sharing economy model fundamentally reimagines telecommunications infrastructure ownership. Rather than concentrating wealth and control in centralized entities, World Mobile distributes both ownership and rewards throughout its community.

==> For EarthNode operators, this translates into direct earnings from network transaction fees which grow naturally with network expansion.

2 - WMTx Token Price Appreciation Drivers

World Mobile’s economic model creates consistent upward pressure on WMTx token value through two powerful mechanisms. First, the project commits 18% of all revenue to automated token buybacks, establishing steady buying pressure that operates independently of market sentiment. As the network expands from its current 500K+ daily active users to potentially millions through planned expansions in Pakistan, the Philippines, and the U.S., these buybacks will intensify proportionally with revenue growth.

source: https://x.com/WMTxLady/status/1867180264108986379Second, WMTx serves as the essential fuel for all network operations. Every call made, message sent, and byte of data consumed requires WMTx for transaction processing. With World Mobile processing over 300 terabytes of data daily – a figure set to multiply as new markets come online – the demand for WMTx tokens grows directly with network usage. This creates a natural supply constraint as more tokens are needed to facilitate increasing network activity.

EarthNode operators benefit directly from this dual pressure system, as their operational revenues are denominated in a token designed to appreciate with network success.

==> The combination of automated buybacks and growing utility-driven demand establishes a solid foundation for long-term token value appreciation.

3 - NFT Scarcity (Only 1,000 EarthNodes ever)

The World Mobile ecosystem created exactly 1,000 EarthNode NFTs, establishing a strictly limited collection of utility-driven assets. This fixed supply takes on new significance when examining the current market reality: only 14 EarthNodes (1.4% of total supply) are available for purchase.

As World Mobile Chain prepares for launch, the value proposition of these scarce assets grows stronger. The imminent activation of network operations will create increased demand for EarthNodes, while simultaneously reducing available supply – operators generating revenue from network usage have little incentive to sell their positions.

=> This fundamental supply-demand dynamic suggests significant upward pressure on EarthNode valuations as the network becomes operational.

4 - World Mobile Multi-Chain Strategy & Liquidity

World Mobile’s strategic integration across multiple blockchain networks significantly expands its market reach and accessibility. Beyond Cardano, and its recent expansion to Base, one of the fastest-growing Layer 2 networks, World Mobile has bridges to Ethereum and BNB Chain, connecting with two of the largest blockchain ecosystems in terms of users and liquidity.

This multi-chain approach opens WMTx to vast new pools of capital and users. Ethereum holders, representing the largest DeFi ecosystem, can now interact directly with World Mobile’s network. Similarly, BNB Chain’s massive user base gains seamless access to WMTx trading and utility. The Base integration adds another rapidly growing ecosystem to this mix, particularly attractive to institutional investors due to its Coinbase backing.

==> For EarthNode operators, this expanded blockchain presence translates into increased token liquidity and broader market exposure.

5 - Early ENO Operation Advantage

The launch of World Mobile Chain offers operators a valuable opportunity to build their delegation position before the network gains widespread adoption. While EarthNodes begin earning returns through their built-in 100,000 WMTx stake, additional delegation can significantly enhance their earning potential. During the initial phase, early operators face less competition for attracting delegators, as fewer nodes are actively seeking stake.

This first-mover benefit becomes particularly valuable as the network matures. Established nodes with a track record and substantial delegation maintain an advantage over newcomers, having already built trust with their delegator base. Just as in other blockchain networks, delegators tend to stick with reliable operators they trust, making early positioning strategically valuable.

==> By establishing a strong delegation base early, operators can secure an additional revenue stream that compounds their base earnings from node operation. This is a powerful incentive to buy and operate rather earlier than later.

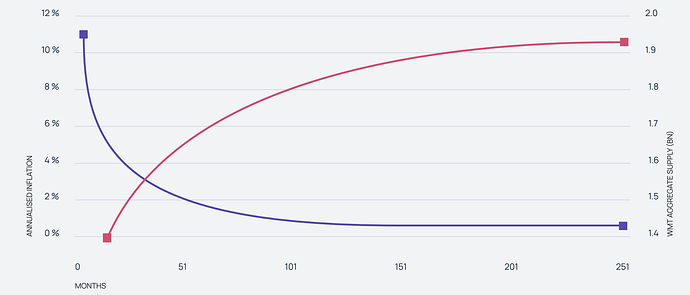

6 - Early Inflation Rewards

World Mobile Chain launches with its highest token inflation rate, providing substantial rewards for initial operators and token holders. This rate follows a decreasing schedule over twenty years until reaching near zero, making the launch period and first year of operation particularly lucrative. These enhanced early rewards compensate operators for supporting the network during its growth phase, when transaction fees from user activity are still developing.

==> The combination of peak inflation rewards and growing network utility means early operators can accumulate significant token positions while providing essential network services.

7 - Performance History Building

In blockchain networks, reputation becomes a valuable asset that cannot be purchased or transferred – it must be earned through consistent operation. Early EarthNode operators have a unique opportunity to establish their performance metrics during the network’s formative period. Successfully maintaining high uptime, efficiently processing transactions, and demonstrating reliable service during the network’s early days creates a verifiable track record that remains permanently recorded on the blockchain.

This performance history becomes particularly valuable as World Mobile expands. New users and services entering the ecosystem naturally gravitate toward nodes with proven reliability, creating a competitive advantage for established operators.

==> Early operators who maintain strong performance metrics essentially build their brand within the network, positioning themselves advantageously for future growth in network activity and potential revenue opportunities.

8 - Built-in Token Stake

Each EarthNode comes with 100,000 WMTx tokens that are staked to the node. This means when purchasing an EarthNode, operators acquire not just the operational rights to the node, but also a significant position in WMTx tokens. These staked tokens generate additional returns through the network’s staking rewards program, complementing the regular operational revenues from running the node.

This bundled token stake essentially provides operators with two revenue streams from a single purchase: earnings from node operations and rewards from the staked WMTx tokens.

==> As the network grows and token utility increases, operators benefit from both their node’s performance and their staked position in the network.

9 - No Delegation Required

Unlike Stake Pool Operators (SPOs) on Cardano who must attract delegators before earning rewards (unless they have sufficient pledge), EarthNodes begin earning rewards without requiring additional delegation. While more delegation increases potential earnings, operators can start participating in the network immediately with their base stake.

==> This removes the common barrier of having to build a following or market your node before generating returns. This access to profitable node operation makes buying an EarthNode particularly interesting.

10 - Additional Revenue Streams

EarthNodes will have opportunities to provide additional services beyond network operations. As World Mobile Chain develops, operators can expand their revenue streams through several specialized services:

Storage-as-a-Service allows operators to allocate their node’s storage capacity for secure data storage needs. VPN services enable operators to provide secure, private network connections to users seeking enhanced privacy and security. Through Authentication Services, operators can facilitate robust identity verification and access management, addressing a crucial need in the digital economy.

Each of these services creates additional revenue opportunities for operators while enhancing the overall utility of the World Mobile network.

==> By leveraging their existing infrastructure to provide these essential services, operators can increase their earning potential.

11 - Competitive Revenue Profile

EarthNodes offer a multi-layered revenue structure that sets them apart from just owning blockchain tokens WMTx or ADA. Let’s analyze the potential returns through a detailed comparison:

Current Market Context

- EarthNode current cost: 82,000 ADA (~$83,490)

- Equivalent in WMTx: 166,431 WMTx

- Built-in stake: 100,000 WMTx (locked in smart contract)

Revenue Stream Comparison

- Traditional Cardano Staking

- Initial Investment: 82,000 ADA

- Annual APR: ~3%

- Year 1 Returns: +2,460 ADA (~$2,500)

- Total Value After Year 1: 84,460 ADA (~$85,990)

- WMTx Token Staking

- Initial Investment: 166,431 WMTx

- Projected APR: 42%* (from https://worldmobiletoken.com/blog/post/what-is-an-earth-node)

- Year 1 Returns: +69,901 WMTx

- Total Value After Year 1: 236,332 WMTx

- EarthNode Operation (Based on latest available data)

- Base Stake Returns (100,000 WMTx): 42% APR

- Node Operation Rewards:

- Minimum (No Delegation): 50,000 WMTx/year

- Equal Delegation across all pools: 56,000 WMTx/year

- Full Delegation: Up to 379,000 WMTx/year

- Additional Revenue Streams:

- Network Service Fees

Projected First-Year Returns

- Minimum Scenario:50,000 WMTx (Base + No Delegation)

- Optimal Scenario: 379,000 WMTx (Base + Full Delegation)

==> As it stands, the earning potential of an EarthNode significantly outperforms Cardano staking (3% APR vs 56% APR), and offers enhanced returns compared to WMTx token staking when factoring in delegation and additional service revenues in year 1, with this advantage compounding in subsequent years. While the initial investment is substantial, the diverse revenue streams and compound earning potential create a compelling value proposition. The upcoming reward structure update in January 2025 will provide even more clarity on potential returns.

12 - Governance Rights and World Mobile Benefits

EarthNode operators gain privileged access to World Mobile’s governance system, allowing them to directly influence the network’s development. This includes voting rights on crucial protocol upgrades, participating in grant allocation decisions, and shaping network policies. Additionally, ENOs receive exclusive benefits like complimentary World Mobile SIM cards, enabling them to experience and test network services firsthand.

==> These governance rights and practical benefits position ENOs as key stakeholders in World Mobile’s ecosystem, adding non-monetary value to EarthNode ownership.

13 - Revenue from Third-Party Services

World Mobile Chain (WMC) is designed as an open platform where other service providers and telcos can build and deploy their applications. As the network’s core infrastructure providers, EarthNodes process all transactions on the chain, including those from third-party services. This means ENOs earn fees not just from World Mobile’s native services, but from all applications running on WMC.

==> This creates a scalable revenue model where EarthNode earnings grow with the entire ecosystem, not just World Mobile’s direct services.

14 - Exit Flexibility

EarthNodes can be sold at any time through NFT marketplaces, with transactions settling instantly on the blockchain. The ability to exit positions at will provides an important advantage over traditional telecom infrastructure investments, which often involve lengthy and complex exit processes involving equipment sales and contract negotiations.

==> While market liquidity may vary, the ability to list and sell an EarthNode position at any time reduces the risk of capital lock-up typically associated with infrastructure investments.

15 - Industry-Leading Profit Potential

Not just one of the most popular - our EarthNodes and AirNodes are going to be among the highest reward generators in the industry.

— Mr.Telecom (@MrTelecoms) June 30, 2024

If you thought you knew and believed it was massive, prepare yourself, it's even bigger.#unstoppable https://t.co/N1Sg9OEdnA

==> According to Mr.Telecom himself, EarthNodes are positioned to become one of the most profitable NFTs.

16 - Low Infrastructure Requirements

Operating an EarthNode requires modest hardware specifications (2 to 4 core, 8GB, 200GB) compared to other blockchain nodes. The infrastructure costs will be at start lower than running a Cardano stake pool, with straightforward setup procedures.

==> The affordable infrastructure costs makes EarthNodes an accessible investment for a wider range of operators.

17 - Inside Access to Network Development

EarthNode operators gain privileged access to World Mobile’s development updates, strategic initiatives, and network improvements before they become public knowledge. This insider perspective enables operators to better understand and adapt to network changes, potentially optimizing their operations and investment strategies.

==> Early access to crucial network information provides ENOs with a strategic advantage in decision-making and network participation.

18 - Strategic Value for Enterprise and Telecommunications Partners

Major telecommunications companies and enterprise partners are likely to seek EarthNode ownership as the network expands. These entities typically want direct infrastructure access to ensure service quality, governance and operational control. With only 1,000 EarthNodes ever created, demand from enterprise players could significantly impact market dynamics.

==> The limited supply of EarthNodes, combined with growing enterprise interest, suggests potential for increased institutional demand and ENNFT valuation growth.

Conclusion

The short-term outlook for EarthNodes presents an interesting dynamic. As World Mobile Chain approaches mainnet, some NFT holders who purchased for speculation rather than operation may choose to exit their positions. However, once these initial sales settle and nodes begin active operation, the fundamental value propositions discussed above - from immediate revenue generation to network infrastructure control - could drive increased demand for the limited supply of 1,000 EarthNodes.

This transition phase reveals multiple layers of value embedded in EarthNodes, spanning network infrastructure, financial returns, and strategic advantages:

- Infrastructure Value: EarthNodes are not just NFTs – they represent essential infrastructure in a rapidly growing telecommunications network serving over 500,000 daily active users, with expansion plans targeting millions more across multiple countries.

- Financial Potential: The combination of built-in staking rewards, operational revenues, and additional service opportunities creates multiple revenue streams. With early inflation rewards and the potential for appreciation in both ENNFT and WMTx value, EarthNodes offer compelling returns compared to traditional blockchain investments.

- Strategic Position: The fixed supply of 1,000 EarthNodes, combined with their critical role in network governance and operation, positions them as strategic assets that may become increasingly valuable as World Mobile expands its global presence.

At current valuations, EarthNodes appear to be priced primarily for their basic operational utility, without fully reflecting their potential as cornerstones of a next-generation telecommunications infrastructure. As World Mobile Chain transitions from testnet to mainnet and begins demonstrating real-world utility at scale, the true value of these assets may become more apparent to both individual operators and institutional partners.

While this analysis explores the various aspects of EarthNode ownership, each potential operator should conduct their own thorough research to evaluate if running an EarthNode aligns with their capabilities and objectives.